Wrappers

The wrappers finalize the model source codes depending on the type of the model:

-

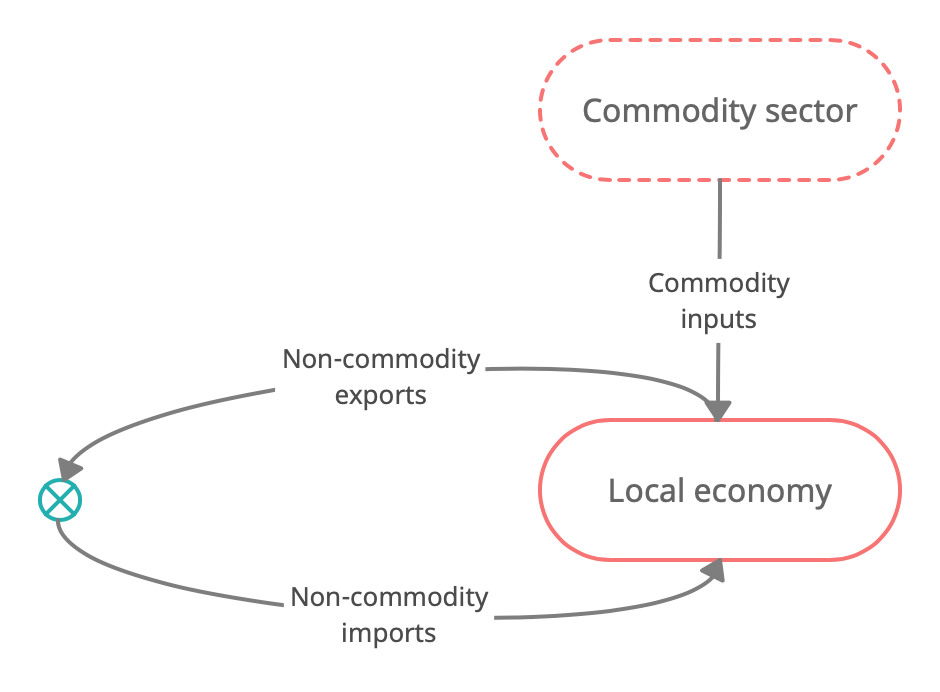

an autarky (a.k.a. closed) economy

-

a multi-area economy

Autarky economy wrapper

Autarky economy wrapper

GEES Wrapper for autarky economy

Declare quantities

!variables

"Global population" gg_nn

"Global population, Y/Y" gg_roc_nn

"Global index of non-commodity export prices" gg_pxx

"Global nominal GDP" gg_ngdp

"Global real GDP index, Y/Y" gg_roc_gdp

"Global per-capita real GDP index, Y/Y" gg_roc_gdp_to_nn

!substitutions

ref_k = k{+1}/&roc_k;

!parameters

"Forward capital adjustment cost parameter" xi_k

"Forex market functioning" zeta_r

Specify equations

!equations

nfa_to_ngdp = 0;

nfa_to_ngdp_checksum = 0;

pmm = fob_pmm * (1 + trm);

fob_pmm = pxx;

e = 1;

rnfa = r{-1};

"Global population"

gg_nn = nn;

"Global population, Y/Y"

gg_roc_nn = nn / nn{-1};

- beta*vh{+1}*rh*pk - vh*xi_k*pk*log(k/($ref_k$)) ...

+ vh*pu*u + gg_zk*zk*beta*vh{+1}*(1-delta)*pk{+1} ...

!! - beta*vh{+1}*rh*pk + vh*pu*u + gg_zk*zk*beta*vh{+1}*(1-delta)*pk{+1};

% !! -vh*pk + vh*pu*u + gg_zk*zk*beta*vh{+1}*(1-delta)*pk{+1} + (vh - beta*vh{+1}*rh)*pk;

"BOP FA corporate equity transactions to GDP ratio"

bpfeq_to_ngdp = 0;

"BOP CA corporate equity primary income to GDP ratio"

bpceq_to_ngdp = 0;

"Corporate equity portfolio"

kk = pk * k;

"Global index of non-commodity export prices"

gg_pxx = pxx_rcy;

"Global demand for commodities"

gg_q = mq;

%

%% Global GDP

"Global real GDP, Y/Y"

gg_roc_gdp = roc_gdp;

"Global per-capita real GDP, Y/Y"

gg_roc_gdp_to_nn = roc_gdp_to_nn;

"Global nominal GDP"

gg_ngdp = ngdp;

%

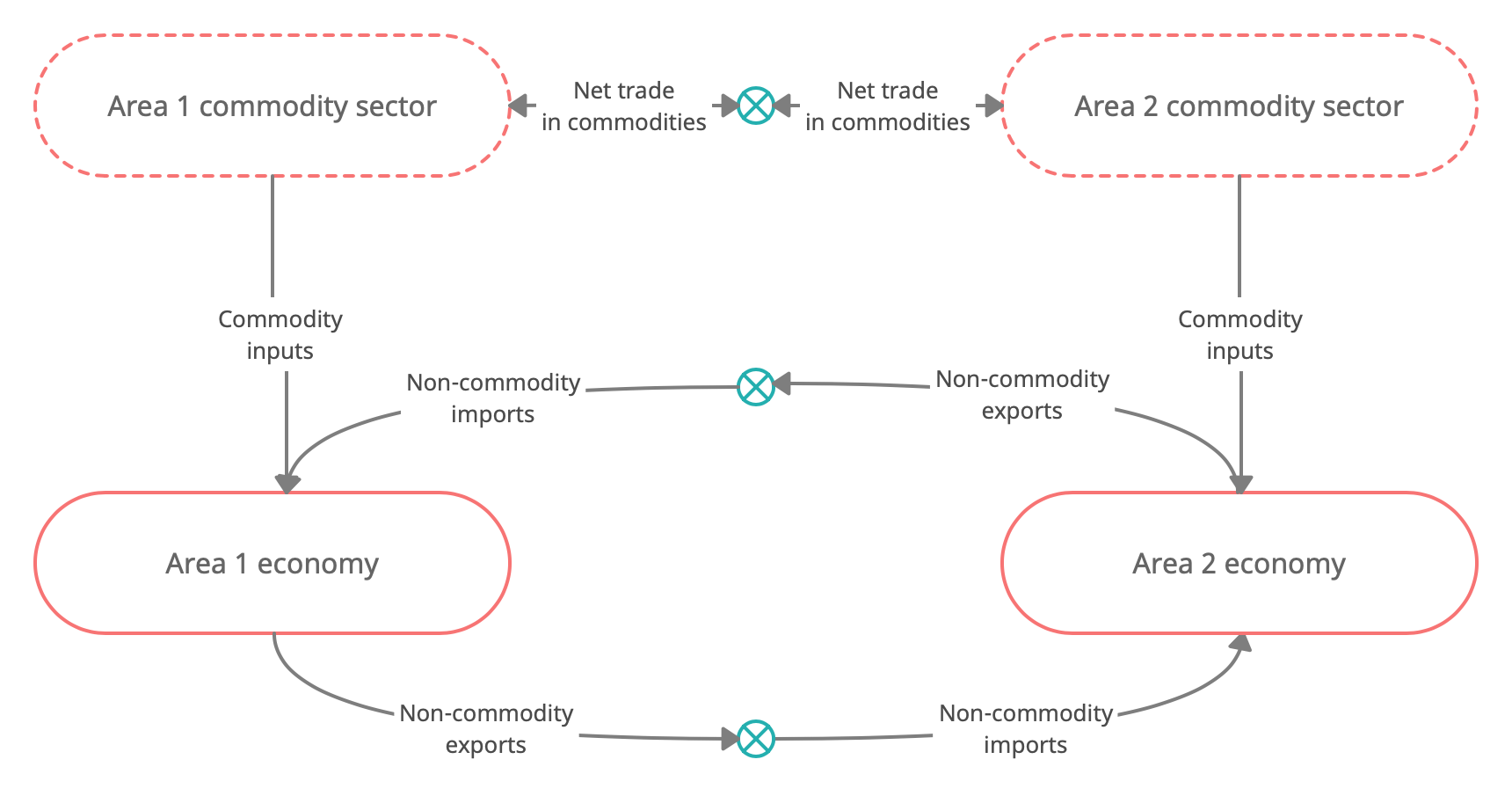

Multi-area economy wrapper

$$ \newcommand{\tsum}{\textstyle\sum} \newcommand{\extern}[1]{\mathrm{\mathbf{{#1}}}} \newcommand{\local}{\mathrm{local}} \newcommand{\roc}[1]{\overset{\scriptsize\Delta}{#1{}}} \newcommand{\ss}{\mathrm{ss}} \newcommand{\aa}{\mathrm{aa}} \newcommand{\bb}{\mathrm{bb}} \newcommand{\E}{\mathrm{E}} \newcommand{\ref}{{\mathrm{ref}}} \newcommand{\blog}{\mathbf{log}\ } \newcommand{\bmax}{\mathbf{max}\ } \newcommand{\bDelta}{\mathbf{\Delta}} \newcommand{\bPi}{\mathbf{\Pi}} \newcommand{\bU}{\mathbf{U}} \newcommand{\newl}{\\[8pt]} \newcommand{\betak}{\mathit{zk}} \newcommand{\betay}{\mathit{zy}} \newcommand{\gg}{\mathrm{gg}} \newcommand{\tsum}{\textstyle{\sum}} \newcommand{\xnf}{\mathit{nf}} \newcommand{\ratio}[2]{\Bigl[\textstyle{\frac{#1}{#2}}\Bigr]} \newcommand{\unc}{\mathrm{unc}} \notag $$

Symmetric two-area economy wrapper

Determination of interest rates in the long run

-

Example of a two-area setup

-

Assume zero inflation in either area for simplicity (hence, nominal interest rates equal real interest rates)

-

With zero inflation differentials and equal long-rung productivity growth (driven by the global productivity growth)

-

Initially, we turn off the net worth effect by setting \(\nu_1=0\)

Interest parity (international debt finance markets) in base rates

Effective household rate (local banking sector)

Euler equations (consumer choice)

-

Effective real interest rates are determined by the discount factor, \(\beta\), and real growth, \(\roc{a}\).

-

The space between the base rate and the effective rate is filled with a premium/spread determined by the NFA position in each area

GEES Wrapper for multi-area economy

Declare quantities

!variables

"Global population" gg_nn

"Global population, Y/Y" gg_roc_nn

"Global index of non-commodity export prices" gg_pxx

"Global nominal GDP" gg_ngdp

"Global real GDP index, Y/Y" gg_roc_gdp

"Global per-capita real GDP index, Y/Y" gg_roc_gdp_to_nn

!parameters

!for ?A=<areas(2:end)> !do

"Forex market functioning" ?A_zeta_r

!end

Define equations

!equations

Multi-area equilibrium and clearing

"Net asset clearing"

0 = !for ?A=<areas> !do + ?A_nfa_to_ngdp * ?A_ngdp / ?A_e !end;

!for ?A=<areas(2:end)> !do

"Interest parity"

?A_rip = <areas(1)>_rip * (?A_exp_e / ?A_e * exp(?A_shk_e))^(1/?A_zeta_r) * (&?A_roc_e)^(1-1/?A_zeta_r);

"Effective NFA rate"

?A_rnfa = <areas(1)>_r{-1} * ?A_e / ?A_e{-1};

"NFA checksum"

?A_nfa_to_ngdp_checksum = 0;

!end

"Global reference currency effective NFA rate"

<areas(1)>_rnfa = <areas(1)>_r{-1};

"Reference currency exchange rate"

<areas(1)>_e = 1;

"Global population"

gg_nn = !for ?A=<areas> !do + ?A_nn !end;

"Global population, rate of change"

gg_roc_nn = gg_nn / gg_nn{-1};

"Global index of non-commodity export prices"

gg_pxx = ...

(!for ?A=<areas> !do + ?A_pxx_rcy * ?A_nxx_rcy !end) ...

/ (!for ?A=<areas> !do + ?A_nxx_rcy !end) ...

;

"Global demand for commodities"

gg_q = !for ?A=<areas> !do + ?A_mq !end;

Global GDP

"Global nominal GDP"

gg_ngdp = !for ?A=<areas> !do + ?A_ngdp_rcy !end;

"Global real GDP, Y/Y"

gg_roc_gdp = ...

!for ?A=<areas> !do + (?A_ngdp_rcy/gg_ngdp + ?A_ngdp_rcy{-1}/gg_ngdp{-1})/2 * ?A_roc_gdp !end;

"Global per-capita real GDP, Y/Y"

gg_roc_gdp_to_nn = gg_roc_gdp / gg_roc_nn;

International comparison

!for ?A=<areas> !do

!variables

"Nominal GDP, Reference currency [?A]" ?A_ngdp_rcy

"Per-capita private consumption" ?A_comp_ch_to_nn

"Per-capita gross production" ?A_comp_y_to_nn

!equations

?A_ngdp_rcy = ?A_ngdp / ?A_e;

?A_comp_ch_to_nn = (?A_ch / ?A_nn) / (<areas(1)>_ch / <areas(1)>_nn);

?A_comp_y_to_nn = (?A_y / ?A_nn) / (<areas(1)>_y / <areas(1)>_nn);

!end